PUBLICACIÓN

Publicación

Autor

Endeavor

Relive the conversation we had with

Magdalena Coronel (IDB) | Adolfo Blasco (Nazca) | Daniela Izquierdo (Foodology) | Andy Tsao (SVB) | Patrick Alex (Endeavor Chile)

Why the study is important if we look at it from the point of view of

VC

This transparency in the decision-making process is beneficial. For one, the more entrepreneurs that understand and meet the criteria for VC investment the more options the VCs have in where to allocate their capital.

ENTREPRENEURS

This is invaluable because to be able to scale-up and make an impact entrepreneurs need capital, and this capital comes from VCs; indeed, a previous Endeavor research effort focused on Chile ranked Access to Capital as the number one challenge in scaling-up. Understanding the exact criteria that Venture Funds use to invest can help entrepreneurs meet those criteria and get the funding they desire.

PUBLIC-POLICY ENTITIES

Understanding what motivates VCs to make certain decisions over others is crucial for designing effective incentives and focus efforts in certain directions.

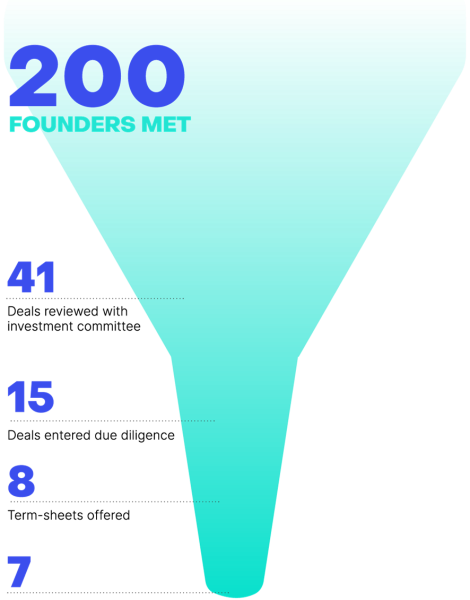

DEAL ORIGINATION

Funds invest only in 7 out of 200 companies they review over one year

The funnel is highly selective: VCs invest in only

3.5% OF PROSPECTIVE COMPANIES

Of the deals that make it to the funnel,

75% OF DEALS ARE REFERRED

BY A VCs NETWORK:

other VC firms, professional networks, existing portfolio companies, LPs and entrepreneurs in residence.

THIS POINTS TO A COLLABOTATIVE INVESTING ENVIROMENT

DEAL ANALYSIS & MAKING

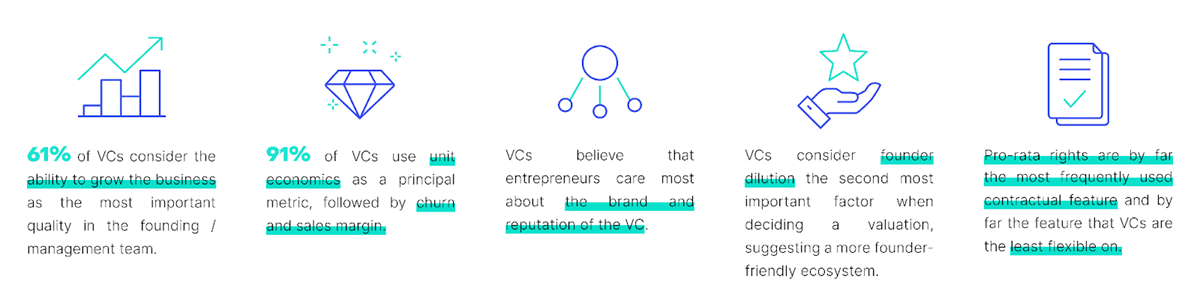

81% of VCs consider the founding team to be the most important factor when it comes to investing in a startup

LatAm VCS invest significant resources in closing deals

On average, the VCs of our LatAm data sample state that they spend

ADDING VALUE

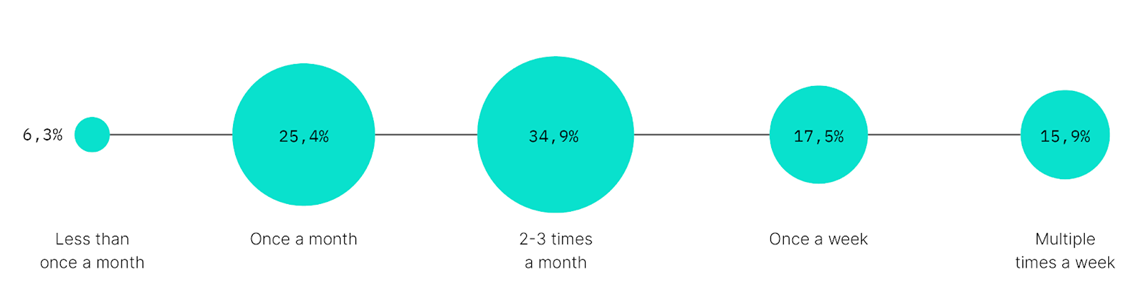

LatAm VCs are high

touch interacting

with their portafolio

2-3 TIMES PER MONTH

Frequency of interaction with founders In the first six months after making an investment, ¿how frequently do you interact substantially with the founders? (n=63)